I keep hearing from clients that they are waiting for the market to crash. And though I can’t speak to the future – none of us can – based on the data we have that is looking like an unlikely outcome at least anytime in the next few years.

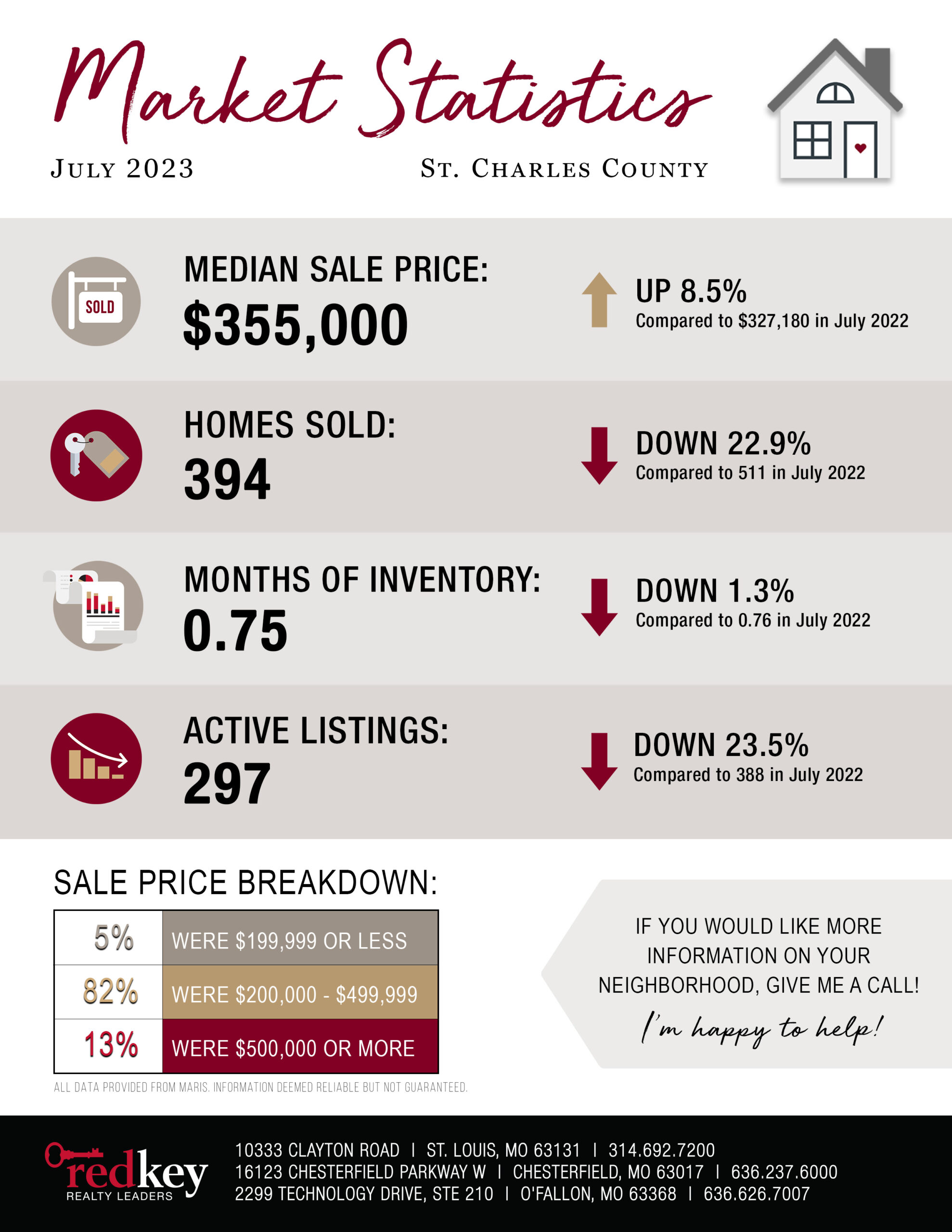

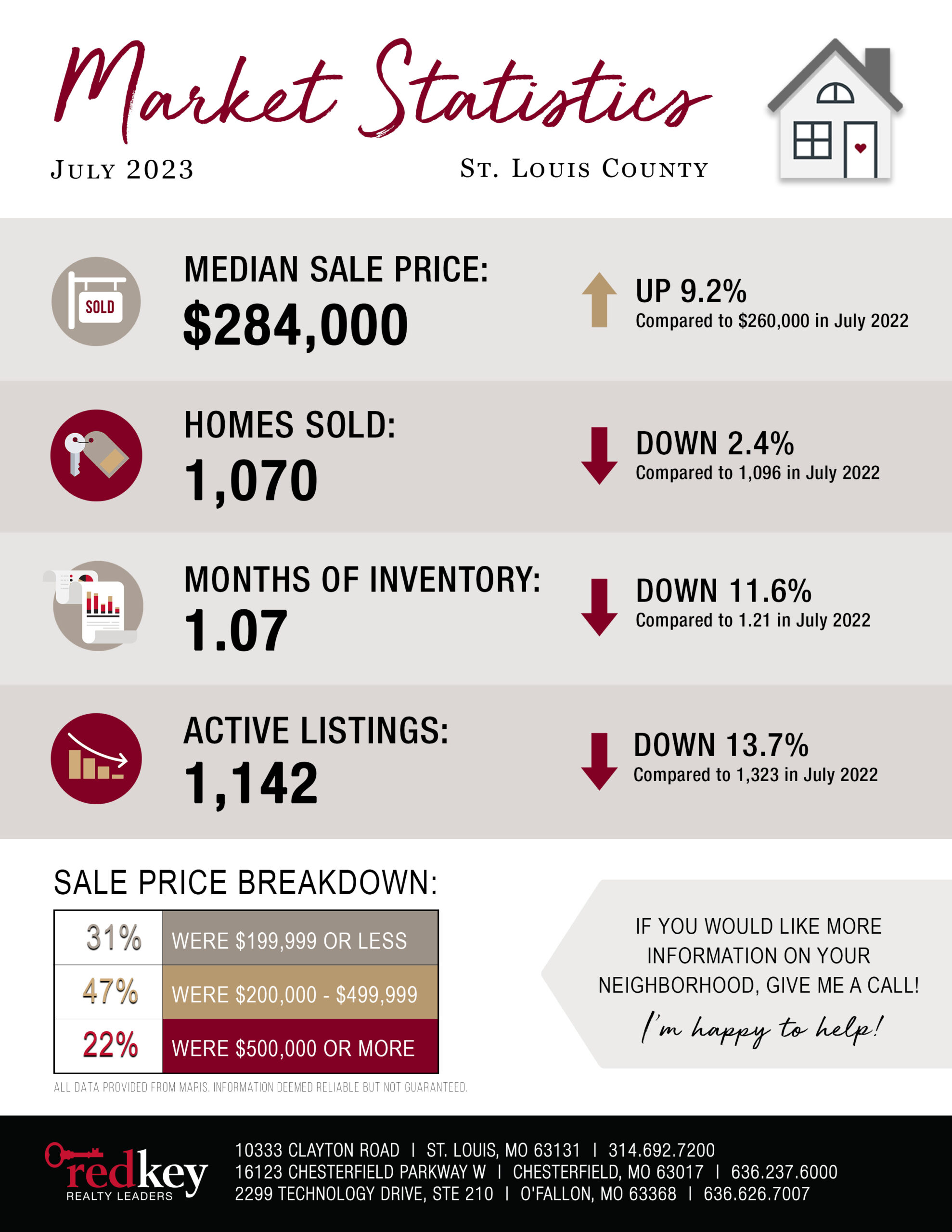

In 2023, there was a market correction in a large part of the country but in July of this year both St. Louis County and St. Charles County increased their home values by over 8.5% from July of 2022. St. Louis city did drop from a median price of $250,000 to $235,000 this year. But the total number of active listings and sold homes also drastically dropped. There were 55 less homes sold in July this year than July last year. That is a 17.5% decrease in transactions. Both counties also had a decrease in number of transactions and active listings. St. Charles takes the cake with a 23.5% decrease in active listings.

With so few homes available to buy, it is going to be hard to convince a seller to lower the sale price of their home. Even with less active buyers in the market due to rising interest rates, there are still more buyers than sellers in the market. Thus, home prices are likely going to stay where they are and continue to rise – though they have slowed.

So why are sellers not selling?

Home owners have record low interest rates!

2020-2022 marked the lowest interest rates in history. In fact, 62% of home owners have an interest rate under 4%. Home owners that bought or refinanced during that period cringe at the idea of moving to a 7% interest rate – which is the current rate as of this week. If interest rates were to fall to around 5% in the coming year, home owners might be more willing to sell but as of right now, it is tough for them to wrap their minds around nearly tripling their rate just to get a new home.

Lending practices are stronger resulting in less deliquiate loans.

Lenders learned their lesson after 2008. It is much harder to get a loan now and lenders do their research to ensure they are lending to someone who can make their payments. This extra work has resulted in less delinquent loans. According to Fannie Mae and Freddie Mac only 5.5% of all mortgages – for the entire country – are more than 3 months delinquent. Couple more qualified buyers with low unemployment numbers and there just aren’t going to be a lot of foreclosures.

70% of home owners have over 50% equity in their home.

The drastic rise in home prices has given home owners who bought prior to 2021 A LOT of equity in their home. This also affects the low foreclosure numbers. Home owners can access that equity in their home to help themselves stay financially strong in the event their families lose a job or have an unforeseen expense.

If you are waiting to buy because you are hoping for a sudden shift in the market, it might be time to reassess that goal. If you aren’t in a rush, then maybe waiting till interest rates drop a little could be smart, but remember, when that happens home prices might also go up again. Buying a home has so many positives to offer including protection against rising rent costs and the ability to grow your net worth. If you have questions about the market or the buying process, please reach out. I would love to chat!